Expand your business to new horizons with local payment methods

- How to evaluate and decide which payment methods to support

- How to integrate new methods as simply as possible

It is an exciting time for cross-border eCommerce

According to the latest publications, the global eCommerce market has climbed to more than $4 trillion by 2020, double from 2018. And the trend has accelerated due to the COVID crisis.

Businesses of all sizes are expanding across borders to reach new customers around the world. But, before rushing to launch localized websites and set up entities in new markets, it’s essential to consider how these international shoppers want to pay.

Hundreds of millions of your potential customers don’t use international credit cards.

Instead, shoppers use a range of local payment methods, like online banking, open invoice, digital wallets, cash and local card schemes. So, to reach your full potential in new markets, you must offer the payment methods your local customers know and trust.

In Germany three-quarters of shoppers prefer not to pay with credit cards and use direct debit.

In China Visa and Mastercard make up a very small proportion of online payments.

In Brazil most cards issued cannot be used abroad as they are not enabled for international use.

Don't forget mobile

Many local payment methods offer mobile-optimized integrations. So, don’t forget to integrate keeping mobile in mind.

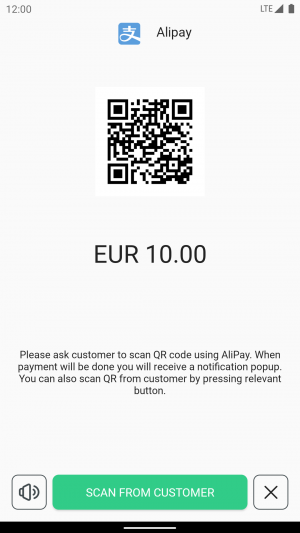

For example, Chinese mobile wallet Alipay, with a reported 520 million active users worldwide, accounts for almost half of the $2 Trillion eCommerce market in China. And WeChat Pay, a part of the WeChat app, is China’s fastest-growing payment method. Both are mainly mobile, and supported online and in-store.

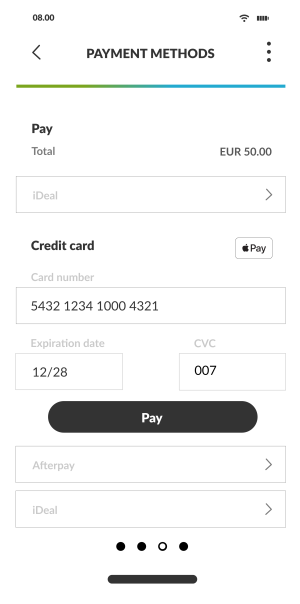

And since iDEAL developed a mobile-friendly payment flow, 50% of iDEAL payments go on mobile. And, consequently, mobile apps that support iDEAL tend to have a higher conversion rate in the Netherlands.

So, if you want to expand to China or serve Chinese tourists, Alipay and WeChat Pay are must-have options. Same goes for iDEAL in the Netherlands, and many other payment methods around the world.

One size does not fit all

When evaluating which payment methods to support, it’s essential to consider your business model. If you’re a subscription business, for example, some payment methods won’t work for you as they don’t support recurring payments. So make sure you recognize the functionalities and restrictions of each method you support.

Support all local payment methods with PayXpert

One contract and one integration with PayXpert gives you access to all key local payment methods around the world, optimised for mobile and ready to go out-of-the-box. No need to set up a local legal entity in each new market; going live is as simple as touching a button.

And to improve the overall experience, you can even serve up a targeted list of payment methods based on your customers’ location, device, and basket value. So each customer only sees the payment methods that are relevant to them.

WE ARE HERE TO HELP

LET’S TALK!

Our Account Managers will support you in the process of integrating digital payments solutions to allow the best experience to your future customers.