3D Secure v2 - Authentication Solution

Increase your conversion rates

Improve customer experience

Une plus grande sécurité dans le commerce électronique

La fraude aux paiements reste un problème auquel toutes les entreprises doivent s’attaquer sérieusement, en particulier dans le domaine des achats en ligne. Le défi pour les commerçants est qu’ils doivent souvent trouver un équilibre entre un risque moindre de fraude et un risque moindre d’abandon du panier. De nouvelles normes techniques réglementaires sont entrées en vigueur le 14 septembre 2019 dans le cadre de la directive révisée de l’Union européenne sur les services de paiement (PSD2), destinée à accroître la sécurité des paiements par carte de crédit dans le commerce électronique dans toute l’Europe.

PSD2 : Nouvelles règles pour les opérations de paiement

Cette directive réglemente le traitement des paiements au sein de l’EEE (Espace économique européen). Le dernier complément à la directive exige, entre autres, une authentification forte du client (SCA) pour toutes les transactions de commerce électronique. Ainsi, les clients effectuant des achats par carte de crédit doivent faire plus que fournir des informations telles que le numéro de leur carte de crédit, la date d’expiration et le code de vérification – ils doivent également procéder à une authentification supplémentaire. Pour faciliter l’adoption du SCA, une nouvelle version de 3D Secure a été publiée, 3DSV2. L’une des caractéristiques de 3D Secure 2 est l’authentification à l’aide de la biométrie, ce qui garantit des transactions plus sûres dans le commerce électronique.

Mise à jour sur les prochains changements du DSP2

Après l’entrée en vigueur de normes de sécurité plus strictes pour les paiements en ligne basées sur la directive PSD2, l’Autorité bancaire européenne a publié son avis en juin. Elle reconnaît les défis que ces changements impliquent en raison de la complexité des marchés des paiements dans l’UE. PayXpert souhaite vous aider dans cette transition et vous recommande de lire les dernières mises à jour.

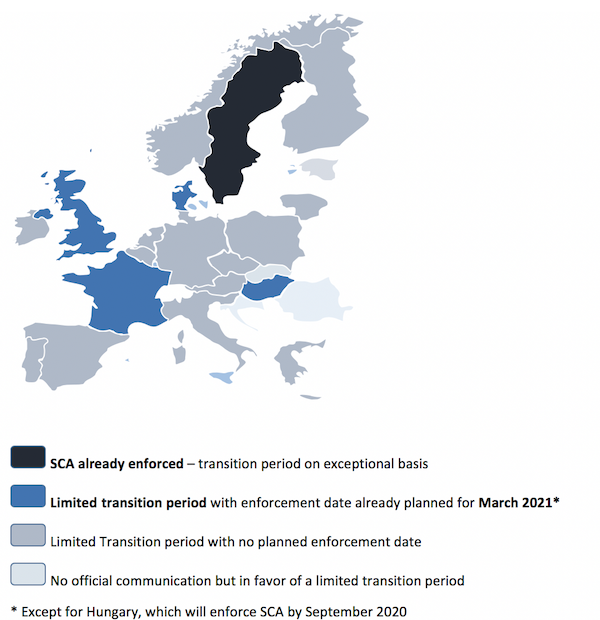

L’Autorité bancaire européenne (ABE) a autorisé les autorités nationales compétentes (ANC) à accorder une période de transition limitée au-delà du 14 septembre 2019 pour permettre une migration sans heurts vers les exigences des ANC sur les marchés de l’EEE.

Le 16 octobre 2019, l’ABE a annoncé que la date limite de fin de migration vers le SCA était fixée au 31 décembre 2020 pour les paiements en ligne sur les marchés de l’EEE.

Dans son dernier avis publié le 18 juin 2020, La Commission européenne (CE) a répondu à l’avis EPIF letter où des acteurs du marché des paiements par carte ont demandé à l’ABE d’accorder « au moins six mois supplémentaires » pour l’application du SCA en raison de la COVID. La CE reconnaît les défis que la pandémie pose au commerce de détail et les difficultés d’adaptation des systèmes informatiques dans les circonstances actuelles. Toutefois, elle estime que le secteur s’est vu accorder suffisamment de temps pour se conformer aux obligations du SCA. Dans ces conditions, la CE ne soutiendrait pas tout nouveau retard dans l’application complète du SCA.

Après cette annonce, nous espérons que les ANC publieront d’autres communications et s’aligneront sur la date limite de migration de l’EBA. PayXpert s’efforcera de tenir les informations à jour pour chaque pays.

La période de transition limitée pour la mise en œuvre de l’ACL PSD2

Vous pouvez trouver un aperçu de les publications les plus récentes des principaux régulateurs ici:

Préparez-vous pour 3D Secure 2

Avec la norme précédente, 3D Secure, l’expérience du client a été considérablement affectée pour des raisons de sécurité. C’est pourquoi les principaux acteurs du secteur des cartes – Mastercard, Visa, American Express, UPI, Diners Club, Discover, JCB et Carte Bancaire – ont vu dans les nouvelles exigences de la PSD2 l’occasion de travailler également à l’amélioration de l’expérience utilisateur. Avec 3D Secure v2, les systèmes de cartes ont introduit une méthode qui, grâce à la nouvelle technologie d’authentification, promet non seulement moins de cas de fraude, mais aussi un taux de conversion plus élevé par rapport à la première version de 3D Secure.

Augmentation votre taux de conversion

while <s’adapter à la nouvelle réglementation

3D Secure vs. 3D Secure 2 comparison

What are the concrete differences?

- Amélioration de la détection et du contrôle des fraudes

- Mots de passe dynamiques

- Amélioration du soutien aux appareils mobiles

- Opt-out des commerçants

- Plus de flexibilité pour le commerçant

Quels avantages le client a-t-il avec 3D Secure 2?

- Une meilleure expérience client

- Réduction des fausses baisses

- Un plus grand confort grâce à l'authentification basée sur le risque

Un aperçu détaillé des avantages de 3D Secure 2 pour vous

Profitez d’une solution de paiement entièrement personnalisable et flexible pour tout modèle commercial de plateforme.

Usage cohérent et flexible sur tous les dispositifs terminaux

Superbe expérience utilisateur

Echange de données optimisé

Nous mettons l’accent sur une expérience utilisateur fluide et significative sur tous les canaux, y compris les portefeuilles et les applications

.

Intégration transparente -invisible- du processus d’authentification avec l’expérience d’achat afin de rendre le paiement aussi peu frustrant que possible

Notre module d’authentification basé sur le risque offre une protection supplémentaire contre la fraude tout en contribuant à stimuler les ventes

Conforme et prêt pour PSD2

PSD2 en Europe et l’évolution des réglementations dans le monde entier imposent de plus en plus d’exigences au commerce. La solution PSD2 de PayXpert, prête pour l’avenir et entièrement sous licence, dispose de tous les outils nécessaires pour rester conforme, même en cas d’expansion mondiale.<

- Modèle de conformité optimal sur chaque marché

- Répond à toutes les obligations PCI avec la tokenisation

- Certification PCI DSS niveau 1

L’authentification forte des clients comme mesure de lutte contre la fraude à l’échelle de l’UE

Il existe de nombreux moyens pour les entreprises de lutter activement contre la fraude, de l’anticipation et de la lutte contre la fraude à la vérification manuelle des paiements en passant par l’apprentissage automatique. Une méthode particulièrement efficace consiste à procéder à une authentification complète pour vérifier l’identité d’un client avant même qu’un paiement en ligne ne soit traité. Il en existe trois types différents : l’authentification à un seul facteur (par exemple, à l’aide d’un mot de passe), l’authentification à deux facteurs (par exemple, à l’aide d’un code d’authentification unique combiné à un mot de passe) ou l’authentification à plusieurs facteurs.